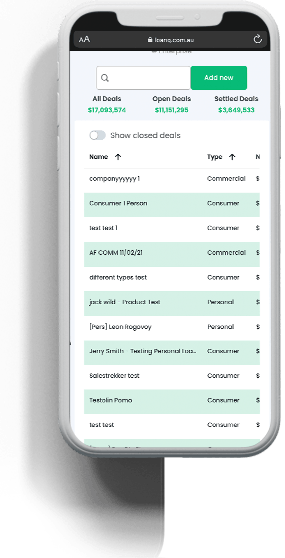

Asset & Personal Finance Origination

BID and NCCP compliant digital origination and a lender gateway for brokers and dealerships.

Used by

Integrated Digital Finance Solution

Intuitive flows for compliant applications in under 15 minutes

Key Benefits

Compliance ready

- Automated compliance document creation

- Best Interest Duty and Responsible Lending ready

- Auditing and reporting functionality

- In-built bank grade Verification of Identity

- Real time in-deal risk assessment

Lender connected

- 40+ asset and personal finance lenders

- Accurate lender calculators

- Detailed up to date lender policy engine

- Lender API lodgements

- Pre populated lender application forms

Fully Integrated

- Banking data feeds open banking ready

- DocuSign integration and automation

- Glass’s and PPSR searches and validation

- Consumer and commercial credit searches

- Address, phone and email validations

Professionally Designed

- In-built product decision tools

- Designed for broker and dealership use

- In-store and online customer self-service use

- Scalable cloud-based architecture

- Mobile and desktop ready

All You Need In One Place

Our Team

Dalibor Ivkovic

Director

Scott Juda

Head of Distribution

Frequently Asked Questions

If you can’t find what you’re looking for, email our support team at hello@loanq.com.au and someone will get back to you.

Who can use LoanQ?

LoanQ is designed for mortgage & finance brokers and for dealership business managers.

Can LoanQ be used on a client facing website?

No. LoanQ is a loan origination platform for brokers and dealers. We have a separate product called WebloanQ that can be embedded on client facing websites to assist lead generation and conversion. Note that website user needs to be eligible to provide asset or personal finance.

Does LoanQ have CRM functionality?

LoanQ isn’t a CRM, however it is linked to Salestrekker CRM, which has extensive CRM functionality.

Is LoanQ a processing company?

No, LoanQ is a technology company. Processing companies can use LoanQ.

Can we white label LoanQ?

Yes, LoanQ is designed to be white-label solution.

Where is LoanQ based?

LoanQ HQ is in Bondi Junction, NSW Australia. All LoanQ data is stored in AWS in Australia.

Which lenders does LoanQ integrate with?

LoanQ integrates with Macquarie, Pepper, Westpac, StGeorge, Capital, Metro, Plenti, Latitude, Liberty, and Shift. Other lenders are currently being added.

Which aggregators can I use LoanQ with?

You can use LoanQ with most aggregators in Australia. ACL holders & dealerships can use it regardless of which aggregator they partner with.

How do I get LoanQ?

Fill in the contact form and we will arrange LoanQ access for you.